US Dividend GROWTH

Inception:

May 2014

7%

Median DGR¹

GIPS

Compliant Firm²

U.S. Dividend GROWTH

Inception:

May 2014

7%

GIPS

Compliant Firm²

Incepted in May 2014, the Blue Current US Dividend Growth strategy builds on the team’s decade of global investing experience to select high quality, US-based dividend-paying companies. The primary objectives are to pay a stable and increasing dividend each quarter and deliver attractive long-term capital appreciation to investors.

The Blue Current investment team concentrates on a select portfolio of 35-45 US domiciled companies that meet our stringent qualities. We focus on companies that we believe have a history of rewarding shareholders and have the financial ability to continue to increase the dividend over time. We strive to purchase those businesses when they are trading at a discount to their true value, delivering to investors a total return solution.

- Concentrated with 35 to 45 companies

- Focused on US domiciled companies

- Process emphasizes companies with rising dividends

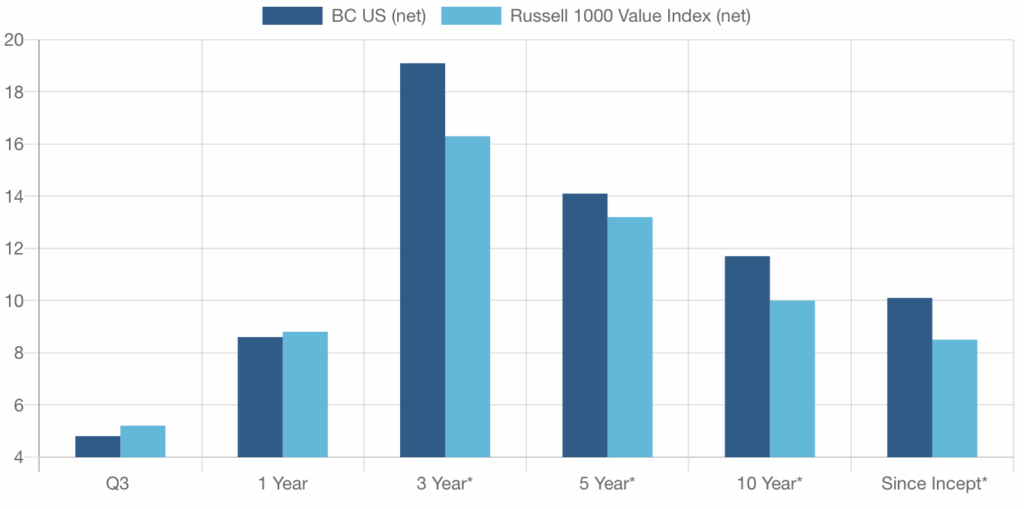

HISTORICAL TOTAL RETURNS

(*annualized)

Portfolio Qualities

Std Deviation Since Inception

14.0%

Positions

35

Median Market Cap ($bn)

$126

Dividend Yield

2.1%

TR One Year Median Div Growth

6.7%

Net debt to EBITDA

1.7

Media Return on Equity

22.6%

Trailing Weighted PE

20.6

Forward Weighted EPS Growth

13.4%

Forward Weighted PE

18.1

Forward Weighted EPS Growth

10.0%

Top 10 Holdings

Weighting

RTX Corporation

4.4%

J.P. Morgan Chase & Co.

4.0%

Broadcom Inc.

3.9%

Microsoft Corporation

3.3%

Morgan Stanley

3.3%

Chevron Corporation

3.3%

Johnson & Johnson

3.2%

Oracle Corporation

3.0%

Targa Resources Group

3.0%

Highwoods Properties, Inc.

3.0%

Sector Exposure

Strategy

Russell 1000 Value Index

Difference

Consumer Discretionary

2.2%

7.7%

-5.5%

Consumer Staples

10.8%

7.6%

3.2%

Energy

6.3%

5.9%

0.4%

Financials

19.9%

22.6%

-2.7%

Health Care

7.5%

11.7%

-4.2%

Industrials

16.7%

13.1%

3.6%

Information Technology

16.8%

10.5%

6.3%

Materials

1.7%

4.2%

-2.5%

REITS

8.4%

4.2%

4.2%

Telecommunications

0.0%

7.9%

-7.9%

Utilities

2.9%

4.6%

-1.7%

Cash

6.8%

0.0%

6.8%

| SECTOR EXPOSURE | Strategy | Russell 1000 Index Value | Difference |

|---|---|---|---|

| Consumer Discretionary | 2.2% | 7.7% | -5.5% |

|

Consumer Staples |

10.8% | 7.6% | 3.2% |

| Energy | 6.3% | 5.9% | 0.4% |

| Financials | 19.9% | 22.6% | -2.7% |

| Health Care | 7.5% | 11.7% | -4.2% |

| Industrials | 16.7% | 13.1% | 3.6% |

| Information Technology | 16.8% | 10.5% | 6.3% |

| Materials | 1.7% | 4.2% | -2.5% |

| REITS | 8.4% | 4.2% | 4.2% |

| Telecommunications | 0.0% | 7.9% | -7.9% |

| Utlilites | 2.9% | 4.6% | -1.7% |

| Cash | 6.8% | 0.0% | 6.8% |